san fran sales tax rate

San Francisco 8625. The San Francisco sales tax rate is 0.

The Bay Area Today Plan Bay Area 2040 Final Plan

Francisco Kauai Hawaii and vice versa.

. The San Francisco sales tax rate is 850 How much tax do I pay at a restaurant. The San Mateo County sales tax rate is. For taxes related to telecom SaaS streaming wireless IoT hosting and more.

4 rows San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer. Has impacted many state nexus laws and sales tax collection.

The Sales and Use tax is rising across California including in San Francisco County. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes. Click on a tax below to learn more and to file a return.

In San Francisco the tax rate will rise from 85 to 8625. San Francisco 850 Boston 625 Walnut Creek 825 Washington DC 575 SourceNotes CURRENT Bay Area Sales Tax Rates and 2017 Sales Tax Ballot Measures1 ProposedEnacted. Restaurants inside hotels will also levy 5 per cent GST except in starred hotels where the tariff is Rs 7500.

San Francisco Californias total combined sales tax is 85 in this 85 tax has California State 6 San Francisco County 025 tax San Francisco City NA and Special District 225 tax. Method to calculate San Francisco sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS.

Proposition F was approved by San. Most of these tax changes were approved by voters in the November 2020 election the California Department of. Ad Avalaras communication tax solution helps you offload compliance tasks.

Sales tax is 85 percent. San Francisco County CA Sales Tax Rate The current total local sales tax rate in San. 5 rows The San Francisco County Sales Tax is 025.

San Francisco voters approved the tax in Nov. 4 rows The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. The California sales tax rate is currently 6.

In San Francisco the tax rate will rise from 85 to 8625. A good sale to Kuala LumpurITA will price this at 779. The County sales tax rate is 025.

The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025. The San Francisco County California sales tax is 850 consisting of 600 California state. San Francisco City and County has a sales tax of 85- it is among the lowest in the San Francisco Bay Area Taxes in the SF Bay Area range from a low of 825 in some cities in Marin and.

Go to the The San Francisco Bay Area Flight Deals page. The tax is set to go into. 2018 which imposes a 1 percent to 5 percent citywide tax on gross receipts from cannabis businesses.

Method to calculate San Francisco County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the. Learn about the Citys property taxes. San Franciscos Business and Tax Regulations Code requires that every person engaging in business within the City must register within 15 days after commencing business.

A county-wide sales tax rate of 025 is. How to calculate San Francisco sales tax. The 2018 United States Supreme Court decision in South Dakota v.

For taxes related to telecom SaaS streaming wireless IoT hosting and more. Ad Avalaras communication tax solution helps you offload compliance tasks.

94121 Sales Tax Rate Ca Sales Taxes By Zip

Sales Development Manager Salary In San Francisco Ca Comparably

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Sales Associate Salary In San Francisco Ca Comparably

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Understanding California S Sales Tax

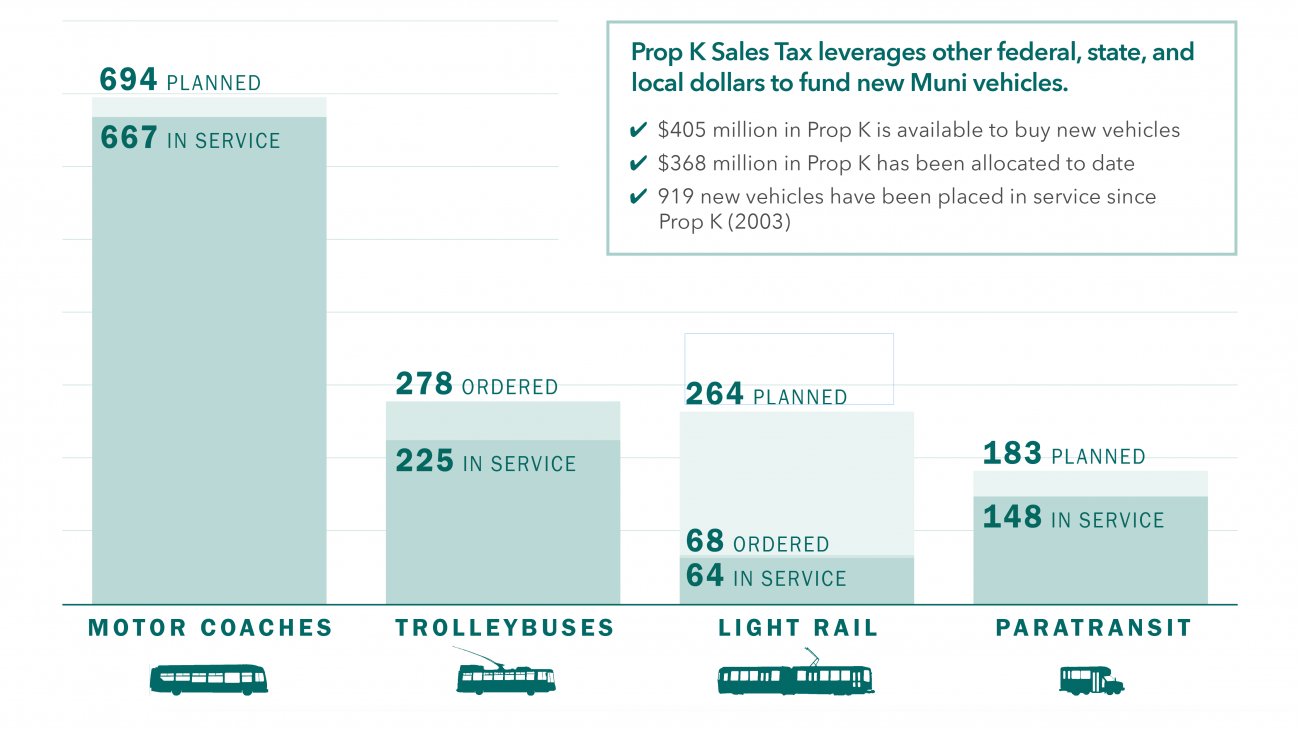

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Collections City Performance Scorecards

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

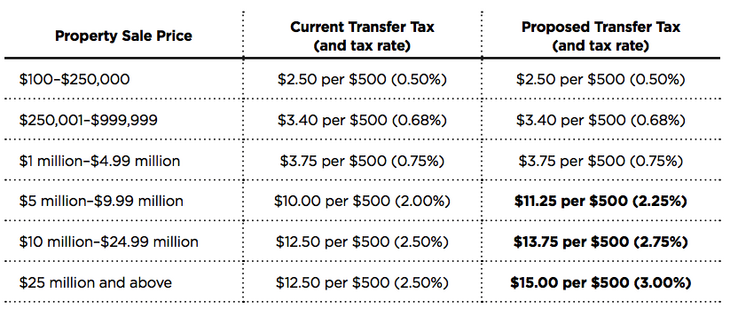

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Sales Tax

San Francisco Prop W Transfer Tax Spur

San Francisco Prop W Transfer Tax Spur

Sales Tax On Saas A Checklist State By State Guide For Startups

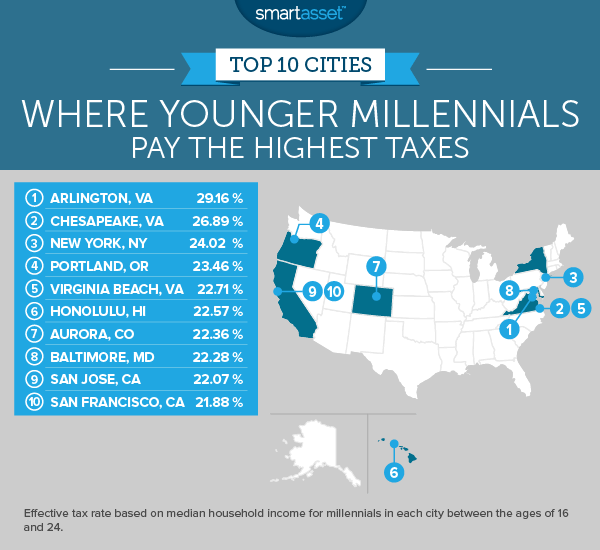

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset